Success Story: EVO Banco

EVO Banco, Bankinter’s 100% digital bank, has as one of its main objectives to be the main bank of any person throughout his or her life. EVO has revolutionized the way of understanding banking by creating an intelligent, simple, transparent and innovative banking system. Its mobile APP offers its customers all the ease, agility and comfort of an online bank and the proximity and professionalism of a network of physical branches.

A Smart Chat for a Smart Bank

The integration of Oct8ne in EVO responds to the bank’s objective of being able to respond to all its customers and help them at any time of the day and from anywhere in the world.

With this new AI integration, Asier de la Torre, head of Digital Origination at EVO Banco, notes that “at EVO we always seek to partner with the best partners to offer the best solutions to our customers and, in this case, Oct8ne is the best solution that is already available to our customers.

Conversion Strategy

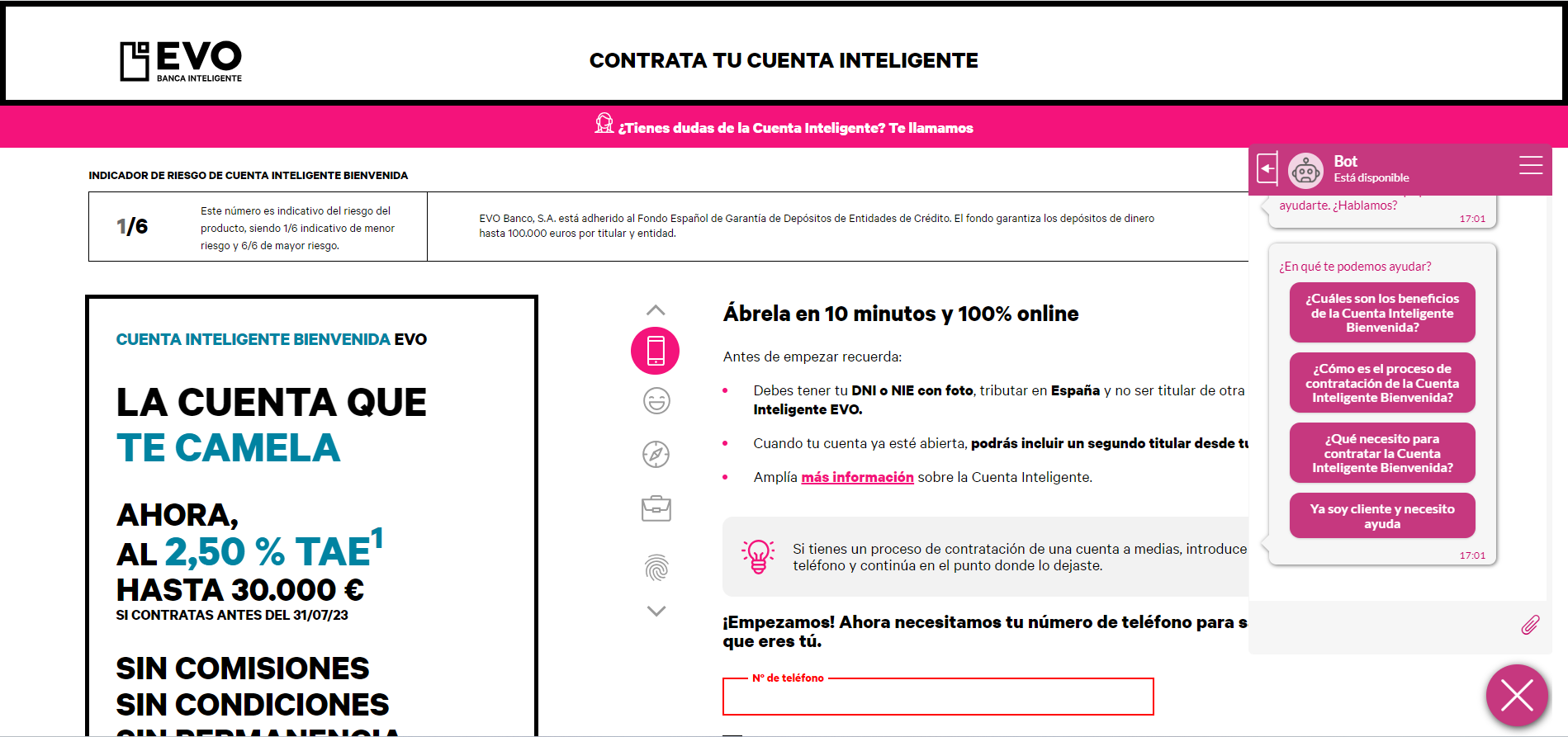

EVO Banco has implemented Oct8ne’s chatbot solution in the EVO Smart Account contracting process with the aim of facilitating, guiding and advising customers without having to contact a manager by phone or email.

“For now, the Oct8ne integration process is aimed at covering the contracting and sign-up process that we currently have at EVO, in order to be able to respond to all queries and obtain conversion metrics”, explains Asier, who also adds: “an existing customer has many communication channels, but during the sign-up process, being a critical process, we are playing with the conversion and we believe that this type of flow is where we can best take advantage of this type of solution. We believe that in the future we could extend its use to other environments”.

The strategy is clear and completes the objective. According to Asier himself, the conversion rate of financial clients who have interacted with the bot in the last 3 months has reached more than 10%.

How Oct8ne is used at EVO Banco

Once contracted, they realized there were two possible branches for the content of their chat: one for doubts or questions related to the product the user is contracting -a financial product that, although it is simple because it is still a bank account, has particular characteristics and an additional layer of intelligence-.

The other branch has to do with the customer registration process -which is usually very agile- and everything related to information at the level of steps, necessary documentation and mistakes that could be made, among others.

Now, when a user has a question, he/she simply clicks on the button containing the topic related to his/her problem to see possible solutions. But the user does not necessarily have to ask for help, because if the bank detects that there is a problem in the registration process, they go ahead with the Oct8ne chatbot and ask them if they have any specific doubts with this step, so that in real time they are shown the main mistakes that people make in the registration process in order to solve the problem.

How did they assist potential customers before implementing Oct8ne?

EVO Banco previously assisted customers through the call center with a human agent overseeing the process, or proactively if they noticed users abandoning the activation process. Additionally, they conducted personalized email campaigns related to abandonment, based on where users were getting stuck in the process and providing assistance to help them continue the onboarding process.

How was Oct8ne implemented?

“The implementation of Oct8ne has been very quick and straightforward,” explains Asier. They autonomously configured the chatbot and, with Oct8ne’s support, implemented and activated the dialogue flows. EVO Banco values how easily they can make modifications to the chatbot’s structure without requiring technical expertise or external support.

What information was considered for Chatbot configuration?

EVO Banco primarily considered two initial lines: the product and problem-solving for account opening. They established that initial questions would be related to the product itself (intelligent account): its features, withdrawal options, ATMs, etc. As the user progresses, the dialogue tree shifts toward solving operational and technical issues at each step of the process. To create the content tree, they relied entirely on the historical data they had regarding customer inquiries.

User feedback on Oct8ne Bot interaction

“It’s good, and in the event that someone says it wasn’t helpful, we redirect them to a phone agent,” confirms Asier. He explains, “There is a high percentage of those who interact with the chatbot to resolve product-related doubts who, after completing the dialogue tree, say it was effective. Approximately 75% of chatbot openings for product-related questions report understanding and finding it helpful.” This contributes to future conversions because the chatbot has resolved their product-related doubts, making conversion more likely.

EVO Banco in numbers

Over a three-month period, EVO Banco received 5,407 help requests, of which 99% were handled by the chatbot. This confirms EVO Banco’s objective of providing autonomous responses to potential new customers, as only a small percentage was directed to human agents. Additionally, 100% of the sessions were initiated without a trigger, meaning users proactively sought help through the chat.

Try Oct8ne’s chat for free now

No credit card required

Companies of all sizes trust Oct8ne to increase their sales: